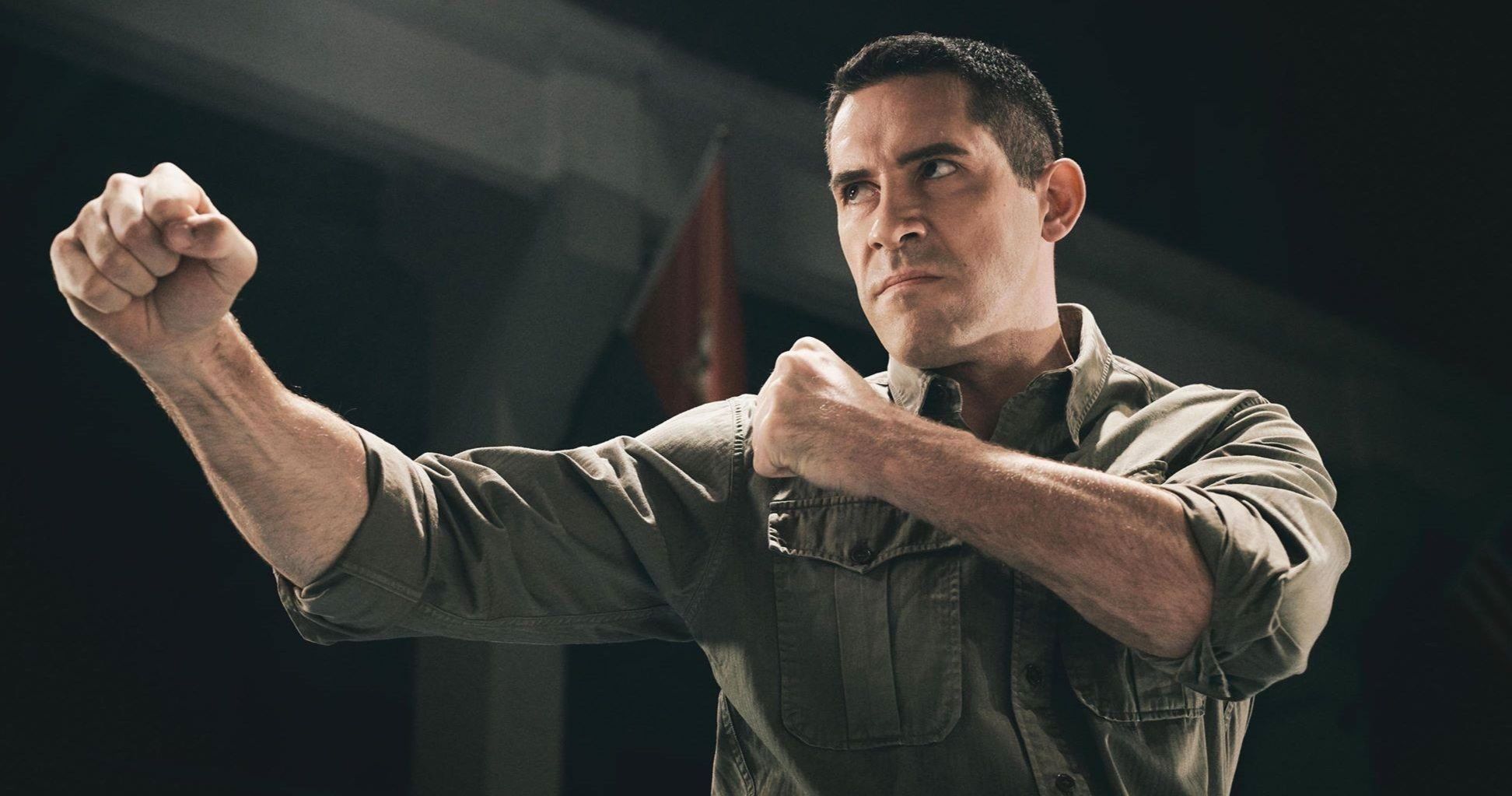

Scott Adkins thinks staring in new Road House movie is the best idea he’s ever heard

Scott, Mr. No-Stunt-Man-Required, Adkins has no problem making a fan’s birthday wish come true. The…

Scott, Mr. No-Stunt-Man-Required, Adkins has no problem making a fan’s birthday wish come true. The…

The advent of online platforms has transformed the way individuals seek and book accommodations, particularly…

I’ve always been a fan of the most unlikely subgenre of all, horror comedy. It…

The Loose Women panelists sparked a heated debate on social media after discussing how a…

The foundation of the anthology is established by gothic cloth animation by Emma De Swaef…

The cancellation policy is a crucial aspect of the guest house accommodation industry, playing a…

Photo: ‘Hausu’ A decapitated head in a wishing well, a piano that eats its player…

Eden’s lifea Nigerian startup that is digitizing home services for households across Africa, has raised…

It is every decorator’s dream to receive gifted antiques from the visionaries who came before…

VDF studio profiles: Transit Studio is a multidisciplinary design practice that eschewed developing a house…

The music in a movie or TV show can often make or break the final…

When Spanish director Alejandro Amenábar was directing The Others, his first English-language film, 20 years…

Booking requirements and cancellation policies play a crucial role in the realm of guest house…

BELLAR, Ah. (WTRF) – Save your bag of popcorn! The infamous Bellaire House, a top-rated…

If you are looking for a home that is grand in symmetry, elegantly proportioned, spacious…

Luxury home interior design marketLatest research study published by HTF MI “Luxury Home Interior Design…

Popcorn and all other concessions will not be sold at the IFC Center, at least…

The booking process for guest house accommodation plays a pivotal role in the hospitality industry,…

While the setting of a horror movie about a haunted house speaks for itself, allowing…

Located at the foot of the Montserrat Mountains in Maresa, Spain, the Dawn house was…

The long-awaited movie The Loud House has released a new trailer with a release date,…

A lifelong dream of owning a weekend home on beautiful Lake Michigan finally came true…

The Way of the Househusband is a Japanese comedy manga series by Kousuke Oono that…

The cost of accommodation is a significant aspect of travel expenses, especially for budget-conscious travelers.…

“The Deep House” seems to be treading on similar ground to “Gonjiam: Haunted Asylum” and…

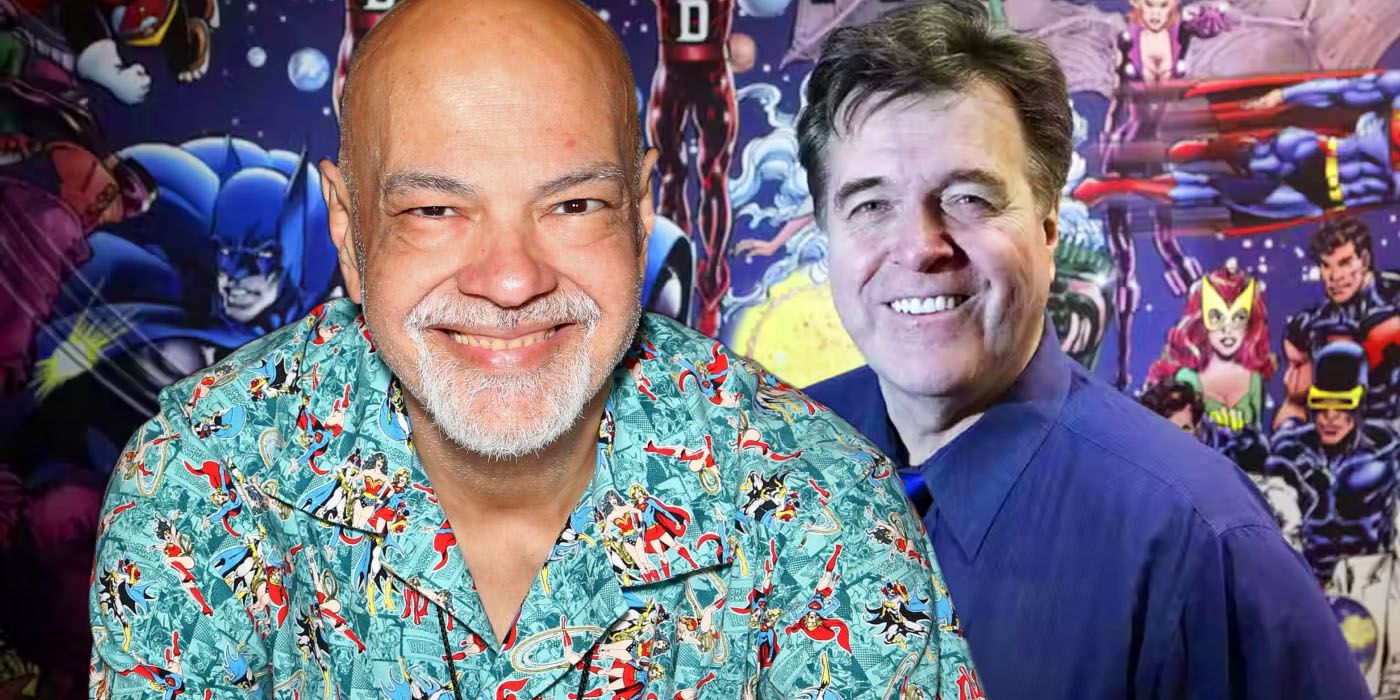

The artists of DC Comics have a solid platform to stand on thanks to the…

Story: The story revolves around an IT professional and his family affairs, busy work schedule,…

In the world of hospitality, guest houses have emerged as popular accommodation options for travelers…

Global Luxury House Interior Design market report gives a comprehensive overview of…

Promotional image for Story 101 (all images courtesy of Netflix) Netflix documentaries have their own…

Boris Johnson and his team used the £ 2.6million White House-style briefing room in Downing…

This season of The Real Housewives of New Jersey showed Teresa Giudice and her daughters…

Credit: Press It has been said that Burko is on a “meteoric rise” to stardom…

The guest house accommodation industry has witnessed significant growth in recent years, with an increasing…

NIGHT TRIVIA AT THE BELL HOUSE! CINEMA CINEMA! Appealing to all moviegoers and casual viewers,…

Yet the most frustrating thing about “There is someone inside your house” has to be…

Image: Syda Productions / Shutterstock.com Now that we’re home most of the time, it seems…

Few interior design jobs are as coveted as the plum mission to decorate the White…

Photo: ‘Hausu’ A decapitated head in a wishing well, a piano that eats its player…

Michael Malapert completes the hidden interior of a hotel in Paris Michel Malapert completed a…

Is something bothering you? Do you need a listening ear or a shoulder to lean…

The comfort and satisfaction of guests are key priorities for the hospitality industry, with room…

ATM withdrawals are a crucial aspect of managing travel finances, especially for individuals seeking guest…

Now that we’re home most of the time, it seems like there’s a lot more…

When done right, haunted house stories evoke not only terror, but genuine pathos as well.…

While some modern-minded Chicagoans rush to demolish these humble mansions – often to build on…

The check-in process is a crucial aspect of guest house accommodation, as it sets the…

This stop-motion animated dark comedy anthology film involving a house across different eras, and the…

In the modern era of digital transactions, payment options have become increasingly diverse and convenient.…

The availability of WiFi in guest house accommodations has become increasingly important for travelers seeking…

Photo: IFC FilmsSomeday everyone you know and love will die. Much of human effort is…

The prevalence of credit card usage in modern society has significantly influenced the way businesses…

The original Alone at home The film has been on the minds of many people…

In today’s increasingly digital world, payment options have expanded beyond traditional methods such as cash…

House hunters looking for heritage properties full of character should take a look at Edwardian…

Looking for summer house interior ideas? Whether you have a garden lounge, a summer house,…

The Dubliner is set to feature in Amazon Studios’ remake of the 1989 action movie…

TOKYO (AP) — Have you ever dreamed of having a gingerbread house like Hansel and…

el shanka-roni – oh well not a good screening – good night Sven everyone :)…

The check-in procedure at guest house accommodations plays a crucial role in ensuring the smooth…

With the growing popularity of guest house accommodations, it is essential for both guests and…

Late cancellation fees are a common practice in the hospitality industry, particularly in the realm…

Bol (Sope Dìrísù) and Rial (Wunmi Mosaku) are a young couple of asylum seekers fleeing…

Reading time: 3 minutesIf you love anime shows or have kids ages 6-12, chances are…

The room is on the first floor of the Alexander House in Springfield, December 2,…

The presence of a mini refrigerator in guest house accommodations has become an essential amenity…

When you live in a small house or an apartment, it is difficult to install…

Now on VOD, The night house is lucky to have Rebecca Hall. The film is…

Traveling can be an exhilarating experience, allowing individuals to immerse themselves in new cultures and…

The key to exceptional room amenities lies in the daily housekeeping practices implemented by hotels.…

A group that runs the nonprofit Passamaquoddy Lodge in Saint Andrews is seeking provincial approval…

A study of 2,000 adults found that a total of 26 hours per month is…

A mother-in-law shared a cute video of her two sons diligently doing chores at homeAccording…

Many countries around the world are currently facing complex issues caused by an expanding aging…

Cast: asher bishop catherine taber Liliana Mummy Nika Futterman Cristina Puceli Generators: Animation The comedy…

In the realm of hospitality, guest house accommodation has gained significant popularity in recent years.…

In today’s fast-paced world, finding suitable accommodation for travelers is an essential aspect of the…

Budget planning is a crucial aspect of travel finances, especially when it comes to guest…

I have always loved small spaces. Although my current small cabin is partly a product…

Two and a half years ago, Sony Pictures emerged victorious in a bidding war over…

University of Tokyo researchers Yuya Sakai, left, and Kota Machida, right, check dried vegetables and…

The pricing of guest house accommodation plays a crucial role in the booking process, as…

In The nest, a family moves into an English country mansion filled with opulent rooms,…

Former UFC two-division champion Conor McGregor will make his feature film debut alongside veteran Hollywood…

The refund policy in guest house accommodation, particularly the cancellation policy, is an essential aspect…

The check-in procedure and deposit policy in guest house accommodations play a crucial role in…

The COVID-19 relief plan adopted in December is expected to distribute $ 15 billion to…

Through Akinwale Akinyoade July 29, 2021 | 11:05 Growing up, we all had to help…

The House is additional proof, if it were needed, that animation can go where reality…

PARCEL: After Makani Young (Sydney Park) moves to Nebraska to escape his scarifying past, his…

![The haunted house movie goes underwater [Exclusive]](https://www.slashfilm.com/img/gallery/the-deep-house-clip-the-haunted-house-movie-goes-underwater-exclusive/l-intro-1635959362.jpg)

“This could be the door to a million views.” James Jagger (son of Mick Jagger)…

SWNS A Danish visitor center has been cleverly built into a hill. The Skamlingsbanken in…

When you live in a small house or apartment, it’s hard to fit in everything…

There is a rich history behind the historic Hannah House mansion. Located in Indianapolis, the…

The Djinn. // Courtesy of IFC Minuit Horror is defined by occult artifacts and spells…

/https://www.thestar.com/content/dam/thestar/life/homes/2022/03/08/an-85-million-white-house-style-mansion-in-thornhill/_1_main_exterior.jpg)

THORNHILLLocation: 12 Thornbank Road,Center St. and Yonge St.Ask for a price: $8,500,000Cut: approximately 8,172 sq.…

Since purchasing their $ 2 million West Hollywood farmhouse-style abode in 2019, Tom Sandoval and…

Many people look forward to the adrenaline rush that comes with watching a horror movie,…

Introduction No-Show Policy: Guest House Accommodation Cancellation Policy Explained In the realm of hospitality, guest…

Photo credit: Alexandre JamesWho is the founder of Studio Peake?After careers at Alidad and Todhunter…

A lady has shared a video of her father spending some quality time with the…

Credit card charges have become an integral part of modern-day financial transactions, particularly in the…

Super Junior Heechul’s 5 billion won luxury villa was featured on a show again, after…

A new socio-political film, “The tenants of the house”, has been released and is theatrically…

While every horror subgenre tends to have clichés, movies set in haunted houses tend to…

The process of booking accommodations, especially for guest houses, can often be time-consuming and tedious.…

Curtis “50 Cent” Jackson is growing his multimedia empire and he wants his son to…

In the realm of hospitality, guest house accommodations play a crucial role in providing comfortable…

This content is imported from YouTube. You may be able to find the same content…

Guest house accommodation has become increasingly popular among travelers seeking a more intimate and personalized…